A household whose members fail to generate sufficient resources to sustain themselves is poor.

At the basic level, a household should be able to generate food, shelter, clothing, education, recreation, and security, enough for all its members.

The choice of addressing the household is based on the deception with which individual incomes delude minds.

An individual who earns an income of 1000 dollars only has 100 for him/herself if there are 10 dependents.

With the increased levels of unemployment, earning individuals increasingly find themselves laden with mouths and hands awaiting income.

The more communitarian the region is, the more the demands on the earner. It becomes all the more logical to focus on a household income i.e. the number of persons that earn, the cumulative earnings, the number of dependents, and finally cumulative expenses.

As we consider expenses, the difference between needs and wants is needed. In a materialistic society, people tend to be valued not for who they essentially are, but by what they have.

Questions like How did s/he look?

What clothes was s/he wearing?

What car was s/he driving?

Where does s/he live?

Who is s/he in relation to the profession?

With such questions, humanity is increasingly objectified.

The human being becomes a thing. To the employer, s/he is a gadget of production.

Indeed maximizing the profits and minimizing the costs fits the efforts.

Consumerism goes hand in hand with materialism. The more we have the more the desire to spend. The more we have the more we justify our increased expenses. On that note, wants speedily change into needs; leisure converts into necessities.

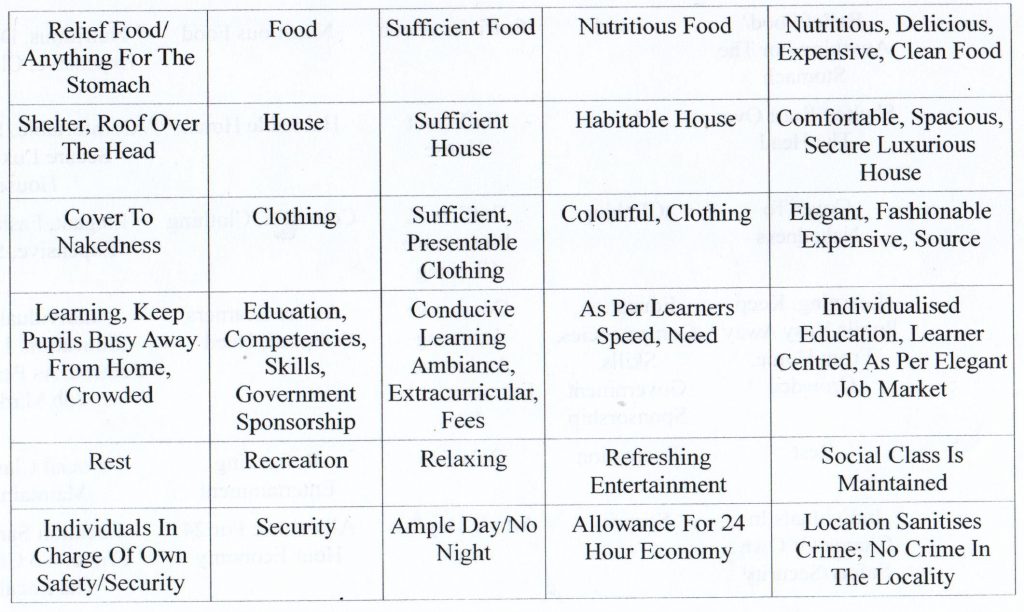

The poorer one is, the less the adjectives attached to food, shelter, clothes, education, recreation, and security.

Table 1 sheds some light.

As we reflect on household economies, it is important to address some often forgotten expenses.

These are discussed in four sub-headings.

The first is the government. With the increased revenue collection authorities, individuals realize that taxes cannot be avoided.

Arguments on transparency and accountability are left for another level of societal development. Postponement of tax payments only contributes to increased stress levels and uncertainties. Sooner or later when a government service is needed, being in good tax books becomes a necessity. Cumulative tax arrears attract penalties. If not checked, this can negatively interfere with the stability of household economies.

Government revenue is an issue in both the developing and the developed world. Increasingly though, the effect in the developing world is higher, due to the inability to earn steadily. This is also coupled with the levels of tax misuse in the name of theft of government resources. This creates unfair economic imbalances among citizens and the value of honesty and handwork is largely challenged. The increased political interference and lack of steady institutions only add to hurting the attitudes of individual taxpayers towards tax payments.

The extended family is another expense that many prefer to either justify or ignore.

A family member in Africa is as wealthy as the poorest family member.

The number of family members contributes towards a common pool, more so when an event is positive or negative. When a majority of the members are struggling economically, efforts to go up the ladder of any individual often become insurmountable.

Extended family pressures on contributions cannot be ignored. With urbanization and with the increase in the materialistic and consumer tendencies, strains are bound to be realized.

Communitarianism is yet another point to consider. It depends a lot on cultural issues within the individual communities. Communities that are more individualistic, generally have less communitarian-related budgets.

While such a virtue, communitarian tendencies also facilitate laziness and irresponsibility taking. After all, my life comfort does not directly relate to the amount I produce.

Again among the developed communities where governments take charge of increased basic needs (education, health) individuals have more monies to spend on the self after-tax payments.

Communitarianism is also aggravated by lack of accountability and responsibility taking of the governments of the respective nations.

The fourth expense is FBOs.

Beneficiaries of FBOs would rather not look at this as an expense to individuals but rather as an expense to God.

Whatever, the position adopted, to the earner, it is cash out. With increased challenges in both the developing and the developed world, there is a need for spiritual nourishment. There is a massive merge between the understanding of spirituality and of religiosity.

Drooping spirits based on economic strains, coupled with ignorance among the very poor and needy, often render their prey to religious deception.

While again the beneficiaries emit venom towards any attempts to question their operations more so their ways of getting and spending money, the realities of the poverty that the flock face calls for questioning.

The development of critical minds through education is important among citizens in developing nations. There is a need to clear the mix-up that exists between spirituality, religiosity, and household economies.

Household Economies cannot be ignored by any one that desires to improve on their wellness.

Reality dictates that human effort is proportional to one’s income.

However, this is often granted an unprecedented turn when unjust ways of wealth acquisition, corruption, negative ethnicity, lack of accountability and transparency in relation to public resources, bring inequality.

Pingback:HEALTH: Foundation and Sustenance for Social Transformation – Afro Heritage Consultancies